Choosing Care

Take advantage of these easy ways to choose the right care for your needs.

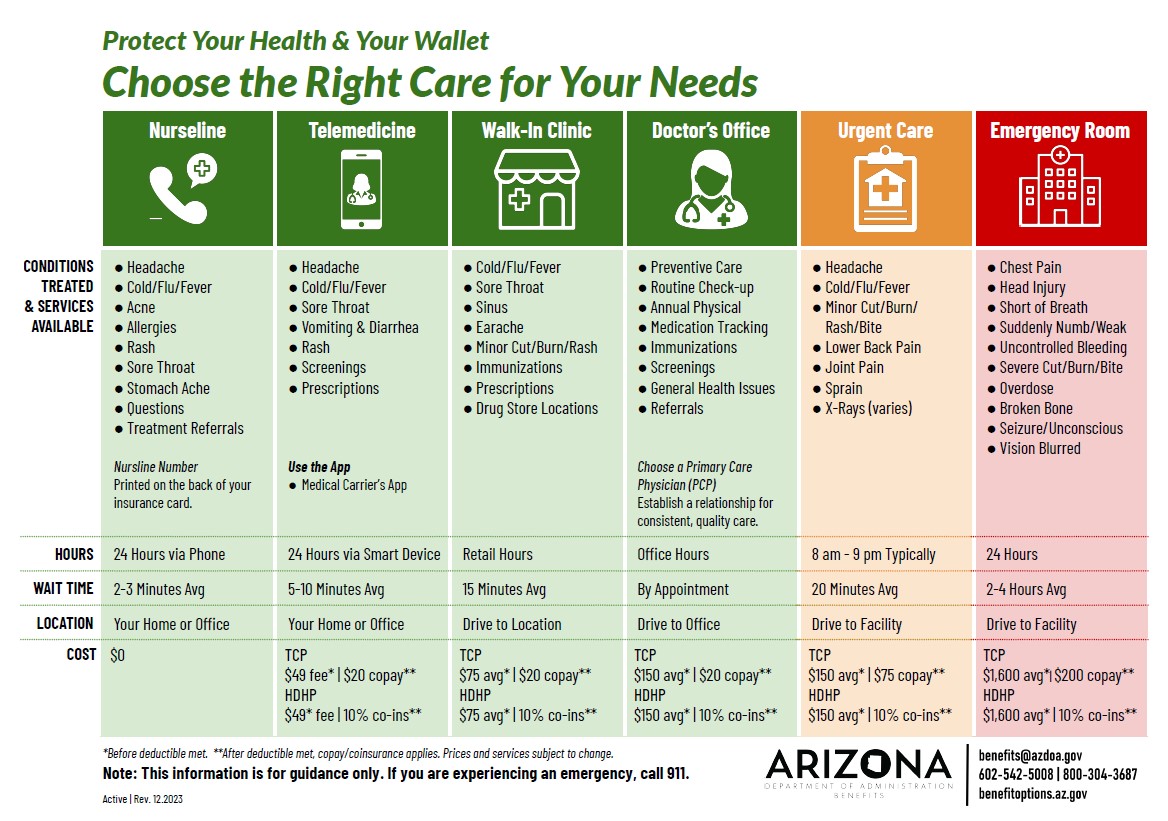

When you visit a provider, how do you know which one suits your situation? Matching the service to the need is key to stretching your healthcare dollar.

- Choosing Care Chart—Our easy-to-read chart below shows the differences in service and costs among your healthcare choices.

- Print Version

PREVENTIVE CARE SERVICES - PROVIDED AT $0 COST

- Our plans include preventive care to prevent illnesses or diseases. Providing these services at no cost is based on the idea that getting preventive care, such as screenings and immunizations, can help you and your family stay healthy. Preventive care may also help reduce your healthcare costs down the road if you catch a problem early or if an immunization keeps you from getting a severe illness. A few examples of preventive care services:

- Wellness visits and standard immunizations.

- Screenings for blood pressure, cholesterol, and Type 2 diabetes.

- Mammograms, prostate exams, and colonoscopies.

- Pediatric screenings for hearing, vision, autism, and developmental disorders.

CHOOSE THE RIGHT CARE FOR YOUR NEEDS - SAVE UP TO $180 ON AN ER VISIT

- Get expert advice on where to go for care by speaking with a registered nurse 24 hours a day, seven days a week, when you call the Nurseline number on the back of your medical card.

- With this $0 cost service, you’ll get help to decide if you need to visit your doctor, urgent care, or the ER.

- Learn more about choosing the proper care in the chart above.

HIP - HEALTH IMPACT PROGRAM - EARN UP TO A $200 INCENTIVE

- HIP is a comprehensive well-being program to help you achieve your physical, financial, personal, and professional well-being goals, all while having fun and meeting milestones along the way.

- Earn enough points this year and be paid the annual $200 incentive in January of next year! Learn more and sign up today.

FLEXIBLE SPENDING ACCOUNTS (FSA) DEBIT CARD - SAVE BY PAYING WITH PRE-TAX DOLLARS

- During open enrollment, you decide how much you want to set aside for medical expenses on a pre-tax basis per pay period. In December, request a debit card from our FSA vendor.

- In January, your debit card is pre-loaded with the entire annual amount you want to set aside. You swipe the card at the doctor’s office or pharmacy to pay for qualified medical expenses.

- If you choose at least the amount of your deductible, you will be able to cover that cost with pre-tax dollars.

- In addition, most people save at least 25% on each pre-tax dollar that is set aside in the program.

- Learn more and plan to sign up during Open Enrollment.